FirstFunding, Flagstar, LAER Realty Partners, Morf Media, Inc. and Plaza Home Mortgage Deliver TILA-RESPA Compliance Training in Boston

Boston, MA (PRWEB) March 26, 2015

Top U.S. mortgage lenders and realtors are teaming up with Morf Media, Inc., developer of enterprise compliance training software-as-a-service for mobiles, to sponsor complimentary training in major cities across the nation. The workshop provides an overview to help industry executives, mortgage originators and real estate agents prepare for new processes, deadlines and archiving rules associated with the upcoming TILA-RESPA integrated disclosure rule to take effect on August 1, 2015.

FirstFunding, a warehouse lending Mortgage company, Flagstar Mortgage Company, LAER Realty Partners, Plaza Home Mortgage and Morf Media Inc. are hosting the session on March 26 at the Sheraton Framingham. Register for the workshop here.

Stacey Alcorn, CEO of LAER Realty Partners commented on the need for training well in advance of the upcoming deadline: “With so many disclosure changes coming down the pike when it comes to the real estate transaction, we at LAER Realty Partners, felt it important to have our agents trained well in advance. Change is not difficult when you are prepared and educated, so our goal is to make sure that each LAER agent heads into the second quarter of 2015 armed with knowledge on the new rules and regulations.”

Know What’s Changing, Use Best Practices and Grow Your Profitability:

With the introduction of the Consumer Financial Protection Bureau (CFPB), tighter qualified mortgage (QM) standards and new ability-to-repay requirements, lenders want to know how to effectively meet regulatory and compliance challenges while successfully growing their businesses.

The TILA-RESPA Integrated Disclosure rule consolidates four existing disclosures required under TILA and RESPA for most closed-end consumer credit transactions secured by real estate into two forms:

Loan Estimate given 3 business days after application

Closing Disclosure given 3 business days prior to consummation.

The training will provide an overview on change management including:

New Loan Estimate Delivery

Closing Disclosure Delivery Timelines

Loan Estimate And Closing Disclosure

New Application Definition Tolerances

Mortgage servicing industry education expert, Ginger Bell commented on the mission for the workshops: “Our sessions introduce best practices and a great networking environment to address the massive issues mortgage experts are facing on many fronts. We coach on ways to deliver clear communications to buyers and service providers about a complex process. At the end of the day, we aim to provide attendees with an effective way to turn a challenge into simple ways to increase profitability while building confidence with their teams, next generation professionals, policy makers and the public.”

The event is designed to provide a high level overview of the new rule. Detailed step by step training on meeting TILA-RESPA compliance is available via Morf Learning, award-winning enterprise training platform for mobiles. Morf Learning is optimized to make enterprise compliance training effective for professionals on the go. It includes a library of certified course content that is delivered in an innovative way to delight and engage employees, partners and administrators with its playbooks for compliance success. It offers powerful analytics engines that show an individual’s progress, strengths and areas needed for improvement, proof of examination and more.

For more information about piloting Morf Learning, please visit http://www.morfmedia.com. Morf Media invites industry training experts to contact us to learn more about the benefits of delivering enterprise training with Morf Learning/

About Morf Media, Inc.

Morf Media, Inc., developer of Morf Learning,™ provides a complete compliance training system via the cloud with built in authoring tools, gamification, smart analytics and reporting for fast, easy delivery to the mobile workforce anytime, anywhere. Morf Media customers are Global 2000 companies running in complex or highly regulated environments, and include the finance, real estate, and pharmaceutical sectors. Founded in 2013, Morf Media is headquartered in San Francisco, California.

For more information about Morf Media, please visit: http://www.morfmedia.com.

For crowdfunding information about Morf Media, please visit Angel List, Gust or Equitynet.

Contact:

Heidi Wieland

Vice President Marketing of Morf Media, Inc. USA

805-722-7413

Heidi(at)morfmedia(dot)com

Attachments

![]() ©Copyright 1997-

©Copyright 1997-

, Vocus PRW Holdings, LLC.

Vocus, PRWeb, and Publicity Wire are trademarks or registered trademarks of Vocus, Inc. or Vocus PRW Holdings, LLC.

Fat Burning Kitchen:Never count calories again

Fat Burning Kitchen:Never count calories again Low Glycemic Veggies

Low Glycemic Veggies 100% protein quinoa grain

100% protein quinoa grain Daily Antioxidant/Natural Remedies

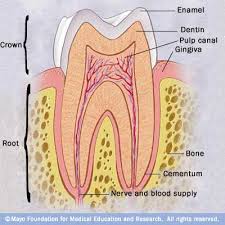

Daily Antioxidant/Natural Remedies Get Truth About Healthy Teeth

Get Truth About Healthy Teeth Healthy Cooking

Healthy Cooking

Leave a Reply

You must be logged in to post a comment.