Question by Fisher: Tax deductions for gluten free food for people with celiac disease?

My wife and 3 children have celiac disease. Can we claim a deduction for having to buy gluten free food? We have not kept receipts. Is there an estimated deduction for this?

Best answer:

Answer by v b

No receipts, no deduction.

From publication 502:

You can include the cost of special food in medical expenses only if:

The food does not satisfy normal nutritional needs,

The food alleviates or treats an illness, and

The need for the food is substantiated by a physician.

The amount you can include in medical expenses is limited to the amount by which the cost of the special food exceeds the cost of a normal diet.

What do you think? Answer below!

Fat Burning Kitchen:Never count calories again

Fat Burning Kitchen:Never count calories again Low Glycemic Veggies

Low Glycemic Veggies 100% protein quinoa grain

100% protein quinoa grain Daily Antioxidant/Natural Remedies

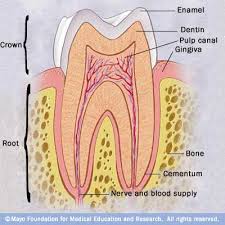

Daily Antioxidant/Natural Remedies Get Truth About Healthy Teeth

Get Truth About Healthy Teeth Healthy Cooking

Healthy Cooking

1 comment

No ping yet

notaperviemusculargent says:

January 30, 2012 at 8:54 am (UTC 0)

So sorry as I know this is very stressful. You MUST begin saving all your receipts. The IRS makes you subtract 7.5% of your adjusted gross income from your medical-health expenses; 10% when figuring alternative minimum tax. You should start a business and then the business related portion of the expenses become deductible. Now, you can deduct none of the expenses in the majority of instances. This is a good thing to get started in. You may have high health insurance premiums. In your situation, I am not sure, but it is certainly worth looking in to. You may be able to deduct quite a bit and 100% of the self-employed health insurance premiums are deductible if you have a business.