Richest 20 Percent of American Households Control 58 Percent of Discretionary Income

Rochester, NY (PRWEB) January 22, 2015

How we spend our money speaks volumes to marketers. Truth is, however, most spending just covers the basics. What’s left – discretionary income – is what really provides the insight. The richest 20 percent of Americans control 58 percent of U.S. discretionary income. The middle class – the next 60 percent of U.S. households or middle three income quintiles – controls 42 percent. The bottom 20 percent essentially has no discretionary income.

Disposable income is household money income from all sources left after taxes. Discretionary income is what’s left after paying taxes and buying food, clothing, shelter, transportation, and healthcare. Also subtracted is 25 percent of spending that accounts for particular “necessities” like, for example, tools for work, child care, or a new refrigerator that are necessary for some but not for all households in a given year. By the way, “food” is food consumed at home, jewelry doesn’t count as clothing, second homes don’t count as shelter, and that flight to Aruba doesn’t count as transportation.

Discretionary income is essentially money available for discretionary spending, and is therefore of particular interest to restaurateurs, travel and hospitality marketers, the entertainment industry, high-end clothing and jewelry stores, wellness/fitness specialists, and just about any business looking for customers with a little extra cash. TGE’s census tract estimates of Disposable and Discretionary Income, for example, permit those marketers to find geographic markets where discretionary income is more concentrated.

Discretionary dollars are flowing in and around the nation’s capital and the down the East coast corridor from Boston to Washington. For example, the top-ten states with the highest average discretionary income per household are: District of Columbia, Connecticut, New Jersey, Maryland, Massachusetts, Virginia, Alaska, California, Hawaii, and New York. Arguably, high cost-of-living states can sap discretionary dollars back into “basic” expenses. But the presence of discretionary dollars can also drive up costs. The typical household in these top ten states, as in all states, has to balance discretionary spending with prudence. Still, product and services marketers who cater to discretionary spenders with the deepest pockets will find opportunity in those top-ten states.

Who are the discretionary spenders? One way to understand them is to look at their age; they are younger than you may think. Householders aged 35 to 44 have the highest average discretionary income — $ 28,083. That’s in part because many of the youngest in that age group are still single and renting. Marriage, having children, and owning a home clearly impact discretionary spending. Nevertheless, householders aged 45 to 54 and 55 to 64 are not far behind with $ 27,846 and $ 26,204, respectively, in average discretionary dollars. Typically, incomes rise with age and work experience while higher cost homes take up some of the slack. “Having fun with a few extra dollars seems to follow its own life-course roller coaster,” according to Thomas Exter, Chief Demographer for TGE Demographics. “But once the home mortgage is paid off, even a relatively lower retirement income can refresh the discretionary kitty.”

Of course, saving and investing “discretionary” dollars is also an option. Financial institutions – from the largest banks to local credit unions – can benefit from this type of data. Putting the numbers on a digital map or a business intelligence (BI) platform can put the “where” into the “how much.”

About TGE Demographics Consulting: TGE Demographics Consulting helps businesses and organizations acquire and understand the demographic information that impacts their operations. TGE provides specialized data products for consumer market analysis and strategic planning. Some TGE demographic data products, such as the Disposable and Discretionary Income estimates, apply to small geographic areas (census tracts and block groups) and can be integrated into BI and GIS software. Other products and consulting services are provided at more strategic, higher geographic levels, including future projections, and are more suitable for long-term planning.

For more information, please contact:

Thomas G. Exter, Ph.D.

TGE Demographics Consulting

Phone: (585) 624-7390

Email: tomexter(at)thedemographics(dot)com

Website: http://www.thedemographics.com

Attachments

![]() ©Copyright 1997-

©Copyright 1997-

, Vocus PRW Holdings, LLC.

Vocus, PRWeb, and Publicity Wire are trademarks or registered trademarks of Vocus, Inc. or Vocus PRW Holdings, LLC.

More Foods For Long Life Press Releases

Fat Burning Kitchen:Never count calories again

Fat Burning Kitchen:Never count calories again Low Glycemic Veggies

Low Glycemic Veggies 100% protein quinoa grain

100% protein quinoa grain Daily Antioxidant/Natural Remedies

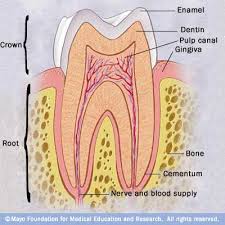

Daily Antioxidant/Natural Remedies Get Truth About Healthy Teeth

Get Truth About Healthy Teeth Healthy Cooking

Healthy Cooking

Leave a Reply

You must be logged in to post a comment.